Service Sector in Rajasthan

• Service sector includes various activities ranging from highly sophisticated activities like computer software and telecommunication to a simple service delivered by a plumber.

• According to the National Accounts classification, the service sector incorporates trade, hotels & restaurants, transport, storage and communication, financing, insurance, real estate, business services and community, social and personal services.

Share of Service Sector in Rajasthan’s GSVA

• Service sector has been consistently increasing in Rajasthan’s economy.

• Gross State Value Added (GSVA) by services at constant (2011-12) prices has increased from 1.62 lakh crore in 2011-12 to 2.95 lakh crore in 2019-20.

• In 2019-20, service sector with a share of 46.63 per cent in Rajasthan’s Gross State Value Added (GSVA) at current price continued to be the largest sector in Rajasthan’s economy.

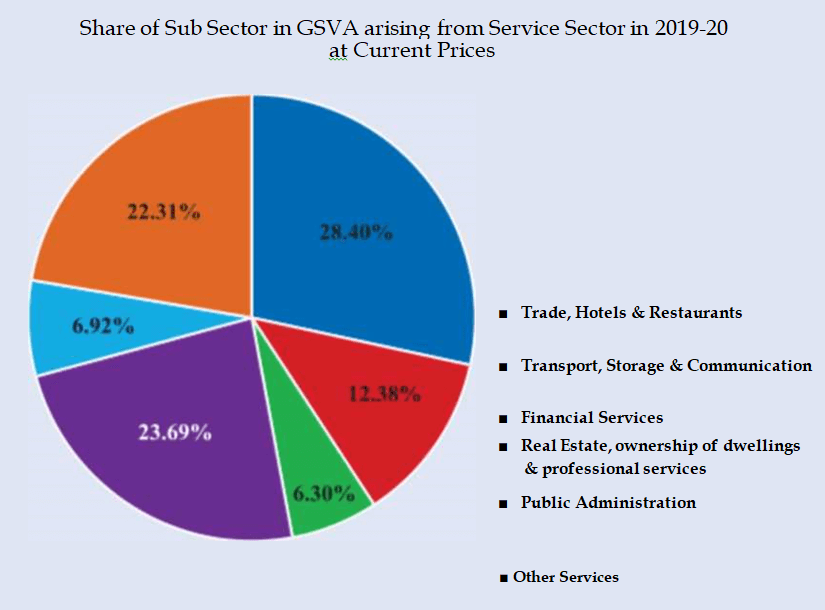

Contribution within Services Sector:

• Trade, Hotels & Restaurants – 28.4%

• Real Estate, Ownership of Dwelling & Professional Services – 23.69%

• Transport, Storage and communication – 12.38%

• Public Administration – 6.92%

• Financial Services – 6.3 %

• Other Services – 22.31%

Rajasthan Tourism

• Endowed with natural beauty and a great history, tourism is a flourishing industry in Rajasthan.

• The state also forms part of India’s golden triangle, a tourist circuit which connects the national capital Delhi, Agra and Jaipur.

During the calendar year 2019, the number of tourist visits in Rajasthan was 538.26 lakh

• 522.2 lakh domestic

• 16.06 lakh foreign

Contribution of Tourism in Rajasthan’s Economy:

• Tourism accounts for approximately 15 per cent of the Rajasthan’s economy and provides economic benefits like foreign exchange earnings, regional development, infrastructure development and promotion of local handicrafts.

• In Rajasthan, tourism accounts for 2.7% (5.2% after adding indirect effects) in Gross State Domestic Product and 1.9% (7.2% after adding indirect effects) in state employment.

• Tourism has a significant multiplier effect on the state economy. It increases employment opportunities, generating revenue, developing infrastructure, increasing investment opportunities and revival of traditions and heritage conservation and management.

• In Rajasthan, tourism is the third largest employer after agriculture and textiles sector.

• Tourism Industry is more gender neutral as compared to other Industries and women account for 65% of the international tourism workforce. For Rajasthan also tourism sector provides enabling platform for increasing labour force participation rate.

• The state runs famous luxury tourist trains such as Royal Rajasthan on Wheels and Palace on Wheels, which connect some of Rajasthan’s important tourist destinations to other states.

State Government Initiatives

Various initiatives have been taken by Rajasthan Government to improve state of tourism in Rajasthan, including:

1. PPP in Tourism Sector:

• Rajasthan Government has identified various projects to be developed in public private participation mode in tourism sector.

• Water based activities like cruise and boating in Chambal and other water bodies.

• ATVs (All Terrain Vehicles) in sand dunes of Jaisalmer / Barmer / Bikaner

• Mountaineering and Trekking activities in Mount Abu / Jaipur

• Establishment of Golf Resorts and Convention Centers.

• Night viewing of monuments at Jaipur, Udaipur, Jaisalmer, Bharatpur, Chittorgarh.

• Development of eco-tourism in various places in state.

• Development of tourism at Sambhar & Jaisamand lake

2. Promotion of Agri-tourism

• Agri-tourism is the incorporation of tourism with agriculture. It promotes agriculture and allied activities as a tourism product and incorporates an operational farm along with a commercial tourism element.

• The concept of Agri tourism was initiated and developed in Europe and North America and has since spread in many countries.

• In India it was initiated in 2005 at Malegaon village, near Baramati, Maharashtra by Agri Tourism Development Company (ATDC).

Activities planned/ takenup by Rajasthan Government:

• Agri-tourism is being promoted in Mega Food Park at Roopnagar in Ajmer.

The park provides facilities for visiting organic farms and learn about different agriculture practices and produce.

Government is planning to open up four more facilities under public-private partnership.

• Government is also considering developing similar visits in orange fields of Jhalawar & Sri Ganganagar, where tourist can see citrus fruits plants, taste them and understand the processing of fruits.

• Agri Tourism will also be promoted in Global Rajasthan Agritech Meets (GRAM).

• Other activities like cow milking, cooking food on rural chulhas made of mud, learning basic rural handicrafts also have potential of developing tourism in villages.

The development of agri tourism can not only helped farmers to hedge their risks from normal farming activities and increase revenues, but also improve their lifestyles.

3. Promotion of Eco-tourism in Rajasthan

• The Government of Rajasthan notified Rajasthan’s Eco-tourism Policy in 2010.

• This policy has been framed with a view to sensitize the public , government departments, NGOs and others about eco- tourism and for laying down the framework for its growth in the State in a sustainable manner.

• Sunda Mata temple in Jalore district, Bassi in Chittorgarh district, Kumbhalgarh in Rajsamand district, Hamirgarh and Menal, both in Bhilwara district have been developed as per guidelines of eco-tourism.

The department of tourism has also submitted proposals to include

• Sariska (Alwar)

• Kaila Devi wildlife sanctuary (Karauli)

• Kumbhalgarh wildlife sanctuary &

• Todgarh Raoli wildlife sanctuary (Rajsamand)

• Mount Abu wildlife sanctuary (Sirohi) and

• Jhalana Safari Park (Jaipur)

for development under the centre’s eco-circuit theme.

4. Government to Government partnerships

• Rajasthan Government engagement with Singapore has led to a direct flight and a skill development centre for hospitality.

5. Holding fairs and festivals:

• Department of Tourism, Rajasthan is engaged in organization of various fairs and festivals to promote tourism in state.

Fairs organized in Rajasthan include:

• Nagaur Fair, Nagaur (Jan- Feb)

• Kite Festival (held on 14th Jan of every year)

• Desert Festival, Jaisalmer (Jan-Feb)

• Baneshwar Fair, Baneshwar (Jan-Feb)

• Gangaur Festival, Jaipur (March-April)

• Mewar Festival, Udaipur (March-April)

• Elephant Festival, Jaipur (March-April)

• Urs Ajmer Sharif, Ajmer (According to Lunar Calendar)

• Summer Festival, Mt. Abu (June)

• Teej Festival, Jaipur (July-August)

• Kajli Teej, Bundi (July-August)

• Dussehra Festival, Kota (October)

• Marwar Festival, Jodhpur (October)

• Bundi Festival, Bundi (November)

• Pushkar Fair, Ajmer (November)

• Matsya Utsav, Alwar (November)

• Kumbhalgarh Festival, Rajasamand (December)

• Winter Festival, Mt. Abu (December)

• Camel Festival, Bikaner (January)

6. Policy incentives:

Rajasthan Government also provides various policy incentives for development of tourist infrastructure including hotels, convention centers, tourist places.

• Incentives available for establishment of hotels in Rajasthan

• Regional Connectivity Scheme to improve intra-state air connectivity.

• Development of a ‘Mega Desert Tourist Circuit’ comprising Bikaner, Jodhpur, Jaisalmer, Pali, Mount Abu and Sambhar.

7. Rajasthan Tourism 3.0

Rajasthan tourism 3.0 is a multiyear, multi-modal, multi narrative and multi-crore global campaign to galvanize tourism in the state.

• Rajasthan Tourism 1.0 lasted from Independence till the early 80s and was powered by Rajasthan’s landscape.

• Rajasthan Tourism 2.0 began in the 1980s with heritage hotels that married historical narrative with commercial hardware.

• But Rajasthan Tourism 3.0 is government’s goal of 50 million foreign and domestic tourists based on enhancement of Rajasthan’s current literature, music and folk festivals with new museums, exhibits and events, strong enough for tourists to plan itineraries around them.

8. Marketing Campaign:

• Rajasthan Government has launched a new aggressive campaign with tagline “Jaane Kya Dikh Jaaye” to market state among tourists.

• The campaign developed by Ogilvy consists of six films and development of new logo of Rajasthan Tourism.

9. Promotion of Religious Tourism:

• Rajasthan Government has decided to renovate 11 religious sites to promote religious tourism in state.

10. Rajasthan Tourism Unit Policy

• In a bid to attract more tourists and ease the setting up of tourism-related projects, Rajasthan revamped its tourism unit policy in 2015.

Highlights of policy are:

• Investment Subsidy of 50% of VAT and CST which have become due and have 19 Rajasthan Tourism Unit Policy 2015 been deposited by the enterprise for seven years

• Employment Generation Subsidy up to 10% of VAT and CST which have become due and have been deposited by the enterprise, for seven years

• Reimbursement of 25% of amount of VAT paid on purchase of plant and machinery or equipment for a period up to seven years from the date of issuance of the entitlement certificate

• Exemption from payment of 50% of Entertainment Tax for seven years

• Exemption from payment of 100% of Luxury Tax for seven years

• Land allotment in urban and rural areas at DLC rates

• 25% additional exemption from payment of stamp duty chargeable on the instrument of purchase or lease of more than 100 years old heritage property in the State, for the purpose of hotel development under the Scheme declared by the Tourism Department

• 50% additional exemption from payment of conversion charges for heritage property converted into a heritage hotel.

• All fiscal benefits to tourism units and heritage hotels will be as per Rajasthan Investment Promotion Scheme, 2014.

11. Development of Ajmer under Pilgrimage Rejuvenation and Spirituality Augmentation Drive (PRASAD) & Heritage City Development and Augmentation Yojana (HRIDAY) Scheme

Conclusion:

• Rajasthan continues to face challenges that impede its growth as a tourist destination.

• The state needs to improve on the sanitation of its public spaces and the ease of travel around the state so as to add to its international appeal.

• The state should also consider providing more online payment and reservation services as more tourists are resorting to using the internet to plan and book their holidays in India.

Rajasthan Economy: An Overview

• Rajasthan, with a geographical area of 3.42 lakh sq. kms, is the largest state in the country.

• Administratively, the State has been divided into 7 divisions and 33 districts.

• Because of factors such as better law and order situation, peaceful environment, excellent road & railway infrastructure and very less population density, currently, Rajasthan is a preferred investment destination in India.

• The progress of Rajasthan is fuelled by diversified economy having agriculture, mining and tourism as the supporting engines.

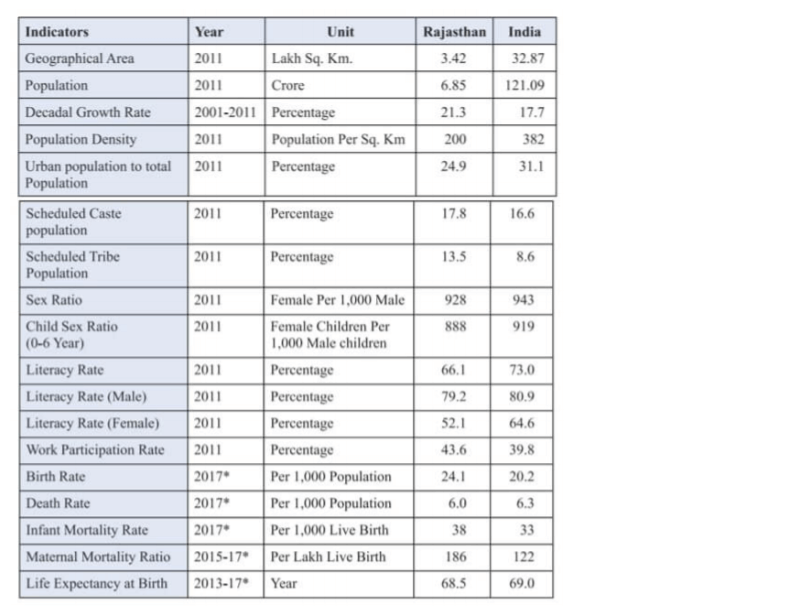

Key Macro Indicators of Economic Development 2019

• These are Macro Indicators of State of Economy 2019, which are published in Feb 2020.

• This is based on data published in Economic Review of Rajasthan 2019-20 and State Budget 2020-21.

State Domestic Product (SDP)

• Estimates of State Domestic Product represent the value of all goods and services produced within the State.

• It is one of the important indicators used to measure the growth of the State’s Economy.

Types of SDP

• The estimates of State Domestic Product (SDP) of the Rajasthan are prepared at both current and constant prices.

• The estimates of SDP are prepared for all the sectors of economy both in terms of Gross and Net basis.

Who Estimates SDP?

• The Directorate of Economics & Statistics, Rajasthan brings out estimates of State Domestic Product on regular basis, and making them up to date from time to time as per the guidelines and methodology provided by the National Accounts Division, Central Statistics Office, Ministry of Statistics & Programme Implementation, Government of India.

Gross State Domestic Product (GSDP)

• GSDP is defined as a measure in monetary terms, of volume of all the goods and services produced within the boundaries of the State during the given period of time, accounted without duplication.

• GSDP is generally known as ‘State income’.

Gross State Value Added (GSVA)

• Gross State Value Added (GSVA) is a productivity metric that measures the contribution to an economy by different sectors.

• Rajasthan, measures GSVA by three broad sectors namely Agriculture, Industries and services.

• Agriculture sector includes Crops, livestock, forestry, and fishing sector.

• Industries sector incudes mining, manufacturing, electricity, gas, water supply & remedial services and construction sector.

• Service sector includes railways, other transport, storage, communication, trade, hotels & restaurant, real estate, ownership of dwellings, public administration, financial and other services sectors.

Important Trends:

• The analysis of sectoral composition of Gross State Value Added (GSVA) at current prices reveals that the progressive decline in the contribution of Agricultural Sector in the economy of Rajasthan.

• The Industry Sector has also declined from its contribution levels in 2011-12. Consequently, contribution of Service sector has increased progressively.

• Sectoral Contribution of GVA (2019-20 AE) at Current Prices by

(a) Agriculture: 25.56%

(b) Industry: 27.81.19%

(c) Services: 46.63%

Contribution within Agricultural Sector:

• Crops – 47.54%

• Livestock -41.53%

• Forestry & Logging – 10.54%

• Fishing – 0.36%

Contribution within Industrial Sector:

• Manufacturing – 35.28%

• Construction -11.73%

• Mining -23.79%

• Electricity, Gas & other Utility Services – 29.18%

Contribution within Services Sector:

• Trade, Hotels & Restaurants – 28.4%

• Real Estate, Ownership of Dwelling & Professional Services – 23.69%

• Transport, Storage and communication – 12.38%

• Public Administration – 6.92%

• Financial Services – 6.3 %

• Other Services – 22.31%

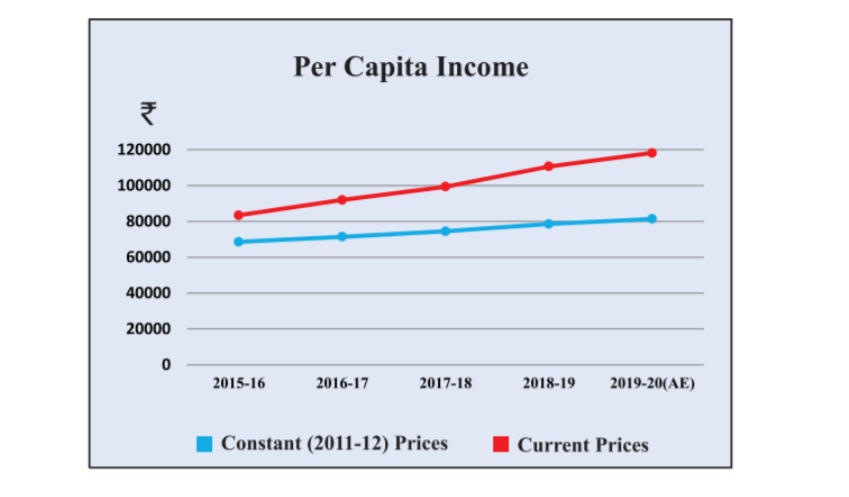

Per Capita Income (PCI)

• The Per Capita Income is derived by dividing the Net State Domestic product by the mid year’s total population of the State.

• Per capita Income is a pointer for standard of living and the well-being of people.

Per Capita Income (2019-20) at:

• (a) Constant (2011-12) Prices: 81,355 INR Rajasthan & 96,563 India

• (b) Current Prices: 118,159 INR Rajasthan & 1,35,050 India

Gross Fixed Capital Formation

The Gross Fixed Capital Formation (GFCF) is measured by the total value of a producer’s acquisition less disposal, of fixed assets during the accounting period plus certain additions to the value of non- produced assets realized by the productive activity of institutional units.

• At the end of the year 2018-19, the total assets at current prices are estimated to be 32,56,731 crore

• This is 27.24% of the GSDP (39,42,586 crore).

• The GFCF in the year 2018-19 increased by 10.63 per cent over the previous year 2017-18.

Important Trends:

• GFCF has been more in Private Sector (73.3%) than Public Sector (26.7%).

• Construction & Public Administration have highest GFCtF formation

• Forestry and Fishing(last) have least GFCG formation.

• GFCF sector-wise:

Construction (Highest) > Residential Buildings > Public Administration > Electricity, Gas, Water Supply > Manufacturing (Reg.) > Manufacturing (Un-Reg.) Trade, Hotels, Restaurant, Transport and Other Service > Agriculture > Communication > Mining > Railways > Banking & Insurance > Forestry > Fishing.

Price Statistics

• Price level is one of the key indicators in the process of economic planning. Changes in prices have a direct bearing on all sections of the society, irrespective of their standard of living.

• One of the foremost concerns of any Government is to exercise regular and periodic control over the movement of prices of essential commodities.

• Price index is a statistical tool to measure relative changes in the price levels of commodities or services in a given region, during a given interval of time.

• To measure inflation at wholesale and retail levels, the commonly used indicators are Wholesale Price Index (WPI) and Consumer Price Index (CPI).

Price Inflation Indices Rajasthan:

• The Directorate of Economics and Statistics (DES) has been collecting the wholesale and retail prices of the essential commodities regularly, since 1957 from selected centres across the State on weekly basis.

• The Consumer Price Indices for industrial workers are prepared and released by the Labour Bureau, Shimla for Jaipur, Ajmer and Bhilwara centres of the State.

• The DES also prepares Building Construction Cost Index for Jaipur Centre.

Wholesale Price Index (WPI) Rajasthan

• Base Year 1999-2000=100

• The primary use of the state level WPI is in computation of GSDP as an indicator.

• WPI serves as an important determinant in formulation of trade, fiscal and other economic policies by the government.

• It is also widely used by the banks, industries and business circles. It is released on monthly

• It covers 154 commodities, of which 75 are from ‘Primary Articles’ group, 69 from Manufactured Products’ group and 10 from ‘Fuel and Power’ group.

• The Wholesale Price Index for ‘All Commodities’ moved from 300.27 in the year 2018 to 310.56 in the year of 2019, registered an increase of 3.43 per cent.

Consumer Price Index (CPI)

• At present there are four different types of month.

• They are Consumer Price Index for

o Industrial Workers (CPI-IW)

o Agricultural Tabourers (CPI-AT)

o Rural Tabourers (CPI-RT) and

o Rural, Urban (CPI-R&U)

• The first three indices are constructed and released by the Labour Bureau, Shimla and the fourth one by the Central Statistical Office (CSO), New Delhi.

The profile of Population in Census 2011

• As per Census 2011, the population of Rajasthan is 6.85 crore.

• The decadal growth rate of the population is 21.3 per cent during 2001-2011 compared to 28.4 per cent in the previous decennial period of 1991-2001.

• The pace of growth has slowed down, but still it is higher than the all India level.

• The population density in the State has increased from 165 per sq.km in Census 2001 to 200 in Census 2011.

• The overall sex-ratio of the population of Rajasthan in terms of number of female per thousand male is 928 compared to 943 of all India.

• The literacy rate of Rajasthan is 66.1 per cent in total and 79.2 per cent and 52.1 per cent for males and females respectively.

Rajasthan Budget 2020-21: Analysis

• Chief Minister of Rajasthan, Shri Ashok Gehlot presented the Rajasthan State Budget for financial year 2020-2021 in the state Vidhan Sabha on 20th February 2020.

• The size of the Rajasthan Budget 2020-21 (which is equal to expenditure or receipts of Government of Rajasthan) is INR 2.25 Lac Crore.

• The size of the Union Budget 2020-21 is INR 30.42 Lac Crore.

Analysis of Union Budget 2020-21

Expenditure:

• The government is estimated to spend Rs 2,25,731 crore during 2020-21.

• Out of the total expenditure, revenue expenditure is estimated to be Rs 1,85,750 crore (% growth) and capital expenditure is estimated to be Rs 39,981 crore (% growth).

Receipts:

• The total receipts (including borrowings) in 2020-21 are estimated to be Rs 2,25,764 crore.

• Out of the total receipts, revenue receipts are estimated to be Rs 1,73,404 crore and capital receipts are estimated to be Rs 52,360 crore.

Budget & Deficit:

• Budgetary Surplus

o = Revenue A c Surplus + Capital A/c Surplus

o = (Revenue Receipt- Revenue Expenditure) + (Capital Receipt – Capital Expenditure)

o = 33 Crore

• Revenue Deficit

o = Revenue Receipt – Revenue Expenditure

o = 12,345 Crore

• Fiscal Deficit

o = Non Debt Receipt – Total expenditure

o = Revenue Receipt+Recovery of loans+Other receipts-Total Exp.

o = 33,922 Crore = 2.99% of GSDP

• Primary Deficit

o Fiscal Deficit – Interest Payment

o 8,428 Crore

Receipts:

• Total = Rs 2,25,764 crore.

• Includes Revenue Receipts (Rs 1,73,404 crore) and Capital Receipts (Rs 52,360 crore).

Revenue Receipts: Trends

• State Own Tax Revenue > Share in Central Taxes > Union Grant > Non-Tax Revenue (Same for FY 2019-20 & FY 2020-21)

• In State’s Own Tax Revenue: GST > Sales Tax > State’s Excise Duty > Tax on Vehicles > Stamps & Registration > Taxes & duties on Electricity > Land Revenue > Other taxes (Same for FY 2019- 20 & FY 2020-21)

• In Share in Central Taxes:

o FY 2019-20: Corporation Tax > GST > Income Tax > Custom duty > Union Excise duty > Other Taxes > Service Tax

o FY 2020-21: Corporation Tax > GST > Income Tax > Custom duty > Union Excise duty > Service Tax > Other Taxes

Capital Receipts:

• Capital Receipts include major component of proceeds from Public Debt, Net Public Account, Contingency Fund.

Expenditure:

• Total = Rs 2,25,731 crore during 2020-21.

• Includes two components Revenue expenditure (Rs 1,85,750 crore) and Capital expenditure (Rs 39,981 crore).

Highlights of Schemes/Projects Outlay 2020-21:

• Rs 1,10,200.82 crore are proposed under Schematic Outlay in Budget Estimates 2020-21.

• The Sector-wise details of the Schemes outlay is as under:

New Boards & Funds in Rajasthan Budget 2020

• On 20th February 2020, Shri Ashok Gehlot presented the State Budget 2020-21 in Vidhan Sabha. Among other things, it included various new welfare boards & proposed constitution of some new funds in Rajasthan Budget 2020-21 as under:

New Welfare Boards:

Rajasthan State Economically Backward Class Board (RSEBCB)

• The RSEBCB will be formed for the welfare of people belonging to economically backward class.

Board of Investment

• The Board of Investment under the chairmanship of the chief minister has been proposed to expedite approval process for large investment proposals which currently takes 3-6 months.

• As per the existing practices, investment proposals above Rs 100 crore are cleared by a state- level empowered committee, after which they go the cabinet for final approval. But once the new board gets instituted, the proposals would not require cabinet approval in normal cases.

New Funds:

Rajiv@75 Fund

• The Budget proposed a Rs 75 core fund for startup on the name “Rajiv Gandhi @75 Fund”.

Nirogi Rajasthan Management Fund

• Under Nirogi Rajasthan, a campaign to create awareness among people to prevent all kinds of lifestyle diseases.

• Each village in the state will have two ‘swastha mitras’ – a male and a female – to spread the door-to-door campaign in the villages.

• Each district will be allocated Rs 1 crore each.

Pravasi Rajasthani Shramik Kalyan Kosh

Nehru Bal Protection Fund

• A separate fund of Rs 100 crore has been proposed for the first time for rehabilitation of children, who are rescued from child labour and other children who needs support and care of the state government.

Tourism Development Fund

• The Rs 100-crore tourism development fund will be used for promoting tourism and developing ‘ease of traveling policy’ in Rajasthan.

• The tourism department will prepare a plan for detailing the areas where the corpus would be spent.

State Budget 2020-21: Seven focus areas as pledges

In February 2020, the state Budget for the first time announced seven focus areas as pledges.

These are:

• First Pledge: Nirogi Rajasthan – Healthcare

• Second Pledge: Prosperity of farmers

• Third Pledge: Welfare of women, child and senior citizens

• Fourth Pledge: Competent workers, students and youth

• Fifth Pledge: Delivery of education

• Sixth Pledge: Water, power and road

• Seventh Pledge: Skill development and technical education

Economic Planning in Rajasthan

• The basic objectives of the successive Five Year Plans has been to achieve a significant step up in the rate of growth of the State’s economy, optimum utilisation of benefits from potential already created, and improving the living conditions of the people specially of the weaker sections.

• At the time of initiation of planning in 1951, the state was involved in problems of integration and so there was lack of basic statistical data required for planning the state.

Review of Five Year / Annual Plans:

First Five-Year Plan (1951-1956)

• In the First Five Year Plan the emphasis was on increasing agriculture production, extension of facilities for irrigation and power, and provision for basic social services i.e. education, medical facilities and arrangement for drinking water supply.

• The outlay for First Plan was kept at Rs 64.50 crores. Against this, an expenditure of Rs. 54.15 crores was incurred.

Second Five-Year Plan (1956-1961)

• In the Second Five Year Plan, Agriculture, Irrigation, Power and Social Services continued to receive attention.

• The Panchayati Raj Institutions were activated and Rajasthan become a pioneer State in introducing 3 tier Panchayati Raj System comprising of Zila Parishads, Panchayat Samities and Panchayats, from 2 October, 1959.

• The outlay for the Second Five Year Plan was kept at Rs. 105.27 crore. Against this an expenditure of Rs. 102.74 crores was incurred.

Third Five-Year Plan (1961-1966)

• In the Third Five Year Plan, creation of infrastructural facilities i.e. irrigation and power, were accorded highest priority.

• An elaborate programme for the industrial development of the State was also initiated.

• The expenditure incurred in Third Plan was to the extent of Rs. 212.70 crores against the outlay of Rs. 236.00 crores.

Fourth Five-Year Plan (1969-1974)

• The concept of area development was introduced in the Fourth Plan.

• The State Government embarked on an ambitious programme for specific areas such as that for the drought prone areas and Command Area Development (CAD).

• Besides this, emphasis was laid on taking up programmes for the creation of employment opportunities and for the upliftment of the weaker sections of the society.

• In this Plan, a sum of Rs. 308.79 crores was spent against the outlay of Rs. 306.21 crores.

Fifth Five-Year Plan (1974-1978)

• Economic emancipation of the weaker sections was accorded a very high priority and target groups oriented programmes were introduced. These target groups consisted of small farmers, marginal farmers, agricultural labourers, scheduled castes and scheduled tribes, etc.

• Minimum Needs Programme was introduced for providing basic social services like elementary education, adult education, rural health, rural roads, rural water supply, rural electrification, rural housing and environmental improvement of urban Kachi bastis and nutrition for children and women. Funds were earmarked under these programmes.

• Concept of area development was further strengthened by formulating a special plan for the tribal areas for accelerating the pace of economic upliftment of the tribals in the predominantly tribal belt of southern Rajasthan.

Rolling Five-Year Plan (1978-1980)

• In the Fifth Plan, against the outlay of Rs. 847.16 crores, the total expenditure incurred was to the extent of Rs. 857.62 crores.

Sixth Five-Year Plan (1980-1985)

• The programmes designed for rural development with the emphasis on poverty eradication and employment generation were accorded high priority in the Sixth Five Year Plan.

• A new Twenty Point Programme which aimed at accelerating the pace of development of the economy and the upliftment of the weaker sections of the society was also adopted in this Plan.

• The Rural Landless Employment Guarantee Programme and Massive Programme of Assistance for Development of Small and Marginal Farmers was also started in this Plan, to attain the objective of providing employment opportunities and raising the income levels of the rural poor.

• A sum of Rs. 2120.45 crores was incurred against the outlay of Rs. 2025.00 crores in the Sixth Plan.

Seventh Five-Year Plan (1985-1990)

• The main objectives of the Seventh Five Year Plan were food, work and productivity. Maximisation of production in key sectors of the economy with special emphasis on rural economy, progressive reduction in poverty and an increasing emphasis on employment oriented programmes. The latter included programmes covered under MNP and Twenty Point Programme.

• In spite of recurrent droughts in the State in the past and particularly during the first three years of the Seventh Plan, the State, by and large was successful in attainment of the objectives as laid down in the Seventh Five Year Plan.

• As against the outlay of Rs. 3000.00 crores, the expenditure incurred was Rs. 3106.18 crores.

Annual FivePlans (1990-1992)

Eighth Five-Year Plan (1992-1997)

• State’s Eighth Five-Year Plan aimed at faster growth, generation of larger employment opportunities, substantial reduction in poverty and regional disparities, provision of basic minimum facilities and greater peoples participation.

• Priority areas of the Eighth Plan included reduction in the rate of growth of population and completion of on-going projects on time to avoid cost and time over-run. Emphasis was on diversification of the agricultural base with greater thrust on the sectors like horticulture, livestock, fisheries, agro- processing, etc.

• The size of the State’s Eighth Five Year Plan (1992-97) was kept at Rs. 11500.00 crores.

• The Basic Minimum Services programme has also been started during the last year of the Eighth Plan.

Ninth Five-Year Plan (1997-2002)

• The basic objectives of the Ninth Five Year Plan are to reduce the gap between the per capita income in the State and the national average.

• Stress was laid on completion of ongoing infrastructure projects, especially on power and water resources along-with a focused thrust on sectors such as horticulture, livestock, fisheries, agro-processing etc.

• The provision of basic minimum services, namely primary education, primary health, safe drinking water, housing, nutrition, village road connectivity and the public distribution system those related to particular attention.

• The total resources available for the State Ninth Five Year Plan were of the order of Rs. 22525.83 crores at 1996-97 prices.

Tenth Five-Year Plan (2002-2007)

• Growth rate in the 10th Five year plan period was at 2004-05 prices was 7.2%.

• Per capita income growth rate was 5.2%.

Eleventh Five-Year Plan (2007-2012)

• The theme of the National Plan was “Towards Faster and More Inclusive Growth”.

• Growth rate in the XI Five Year plan has been estimated at 6.5%. During 2010-11 the growth rate was 11.2% which was the highest one during the 11th Five year plan period.

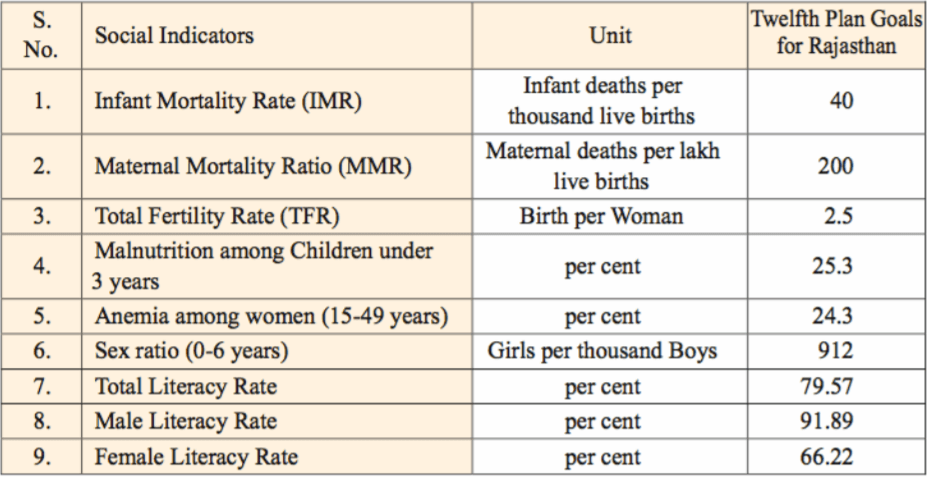

Twelfth Five-year Plan (2012-17)

• The theme of 12th Five-year plan was “Faster, Sustainable and More Inclusive Growth”. An outlay of INR 1,96,992 has been proposed for 12th Five Year Plan.The Economic Growth Targets of 12th Five Year Plan are:

Sector Target for Twelfth Plan for Rajasthan

Agriculture 3.50

Industries 8.00

Services 9.50

Total Growth Rate 7.70

Some Monitor-able Socio-Economic Parameters:

Recent changes in approach:

• With the scrapping of planning commission, the era of Five years plans has come to an end. The 12th Five-year plan (2012-17) was India’s last Five Year Plan.

• The Niti Aayog, which has replaced the Planning Commission, has launched a three-year action plan from April 1, 2017. Niti Aayog has also been entrusted the work on the 15-year Vision Document and a seven-year strategy, which would guide the government’s development works till 2030.

• At the State Level, Planning Department, Government of Rajasthan remains the nodal office associated with Economic Planning in Rajasthan. Additionally, Directorate of Economics and Statistics was established in the year 1956 as the Principal Statistical Organisation in the State to feed the planning needs.

New Economic Policies

• The current Government of Rajasthan has taken steps to create a policy environment that nurtures private enterprise and makes investing in the State profitable.

• In addition to a general package of financial incentives, sector-specific policies have been formulated to promote investment.

New Economic Policies and Programmes of Government of Rajasthan

• Rajasthan Investment Promotion Scheme, 2019

• Rajasthan Industrial Development Policy 2019

• Rajasthan Solar Energy Policy 2019

• Rajasthan Wind & Hybrid Energy Policy 2019

• Rajasthan Agro-processing, Agri-business & Agri-export Promotion Scheme – 2019

• Draft – Rajasthan Start-up and Innovation Policy 2019

• Rajasthan Bio-fuel Policy

• Rajasthan Mineral Policy 2015

• Rajasthan Tourism Unit Policy 2015

• Rajasthan Startup Policy 2015

• Rajasthan MSME Policy 2015

Rajasthan Investment Promotion Scheme, 2019

• The State Government of Rajasthan, has recently issued “The Rajasthan Investment Scheme, 2019” (RIPS-2019) to provide benefits to eligible manufacturing and services sector enterprises.

• Additionally, the scheme also aims to generate employment opportunities and promote rapid, sustainable and balanced economic growth in Rajasthan.

• The Scheme Rajasthan Investment Promotion Scheme, 2019 (RIPS 2019) has come into effect from 17 December 2019 and shall remain in force up to 31st March 2026.

Salient Features of Rajasthan Investment Promotion Scheme, 2019 (RIPS-2019)

Industry 4.0

• RIPS 2019 defines Industry 4.0 as the enterprises engaged in big data & analytics, artificial intelligence, nano technology, quantum computing, fifth-generation wireless technologies, simulations, horizontal & vertical system integration, cyber security, cloud, additive manufacturing and augmented reality across the business value chain.

Investment not eligible for benefits of subsidies/ exemptions under RIPS 2019

1. Investment for manufacturing tobacco, tobacco products and pan masala.

2. Investment made in cow beef processing units.

3. Investment made in retail / trading activities.

4. Any activity which is prohibited by Central/ State laws.

Rajasthan Industrial Development Policy, 2019

• Industries play vital role in economic development of the state. The industrial contribution (27.8%) to States economy is growing continuously.

• The Rajasthan Industrial Development Policy, 2019 has been prepared with a view to promoting inclusive, balanced, sustainable and eco-friendly industrial development, creating infrastructure and employment opportunities, promoting balanced regional industrial development to emerge Rajasthan as the most preferred investment destination in India with a robust eco-system.

Rajasthan Industrial Development Policy, 2019 – Mission

• To develop and maintain industrial infrastructure

• To offer competitive fiscal incentives

• Maximize potential of human capital of the State

• Most efficient utilization of natural resources

• Special focus on ‘Backward’ and ‘Most Backward’ areas

• To foster entrepreneurship & innovation

• To promote industrial symbiosis and environmentally sustainable industrial development

• To support technological up gradation of Industry

• To usher in the new era of Industry 4.0

• To rationalize regulations and inspections

• To instil pro-industry outlook

• To strengthen the following thrust sectors of the State

Salient Features:

• Nodal Department:

o The Department of Industries shall be the administrative Department for the implementation of policy.

o It shall oversee functioning of all important sections/ agencies involved in policy implementation.

o It shall formulate detailed guidelines regarding policy provisions in consultation with concerned State Government departments.

• Industry 4.0

o Incentives for technology acquisition, skill development and R&D.

o R&D centres for bringing together researchers, industry and academia.

o Promote “smart factory” concept, special fiscal and infrastructure support to units using automation and data exchange in manufacturing technologies.

o Support to State incubators for upgrading facilities with new age technologies such as Internet of Things (IoT), FinTech, Clean Energy, Climate Engineering, Clean Transportation, Social Media, Mobility, Analytics, Cloud Computing, Robotics, Artificial Intelligence as well as in Pharmaceutical and Healthcare sectors.

Export Promotion Council

• An autonomous body of exporters, Rajasthan Export Promotion Council (REPC), shall be constituted to create mechanism of facilitation across all sectors for providing policy & regulatory inputs, issues & challenges in exports and probable solutions

Draft – Rajasthan Start-up and Innovation Policy 2019

• Rajasthan announced its startup policy in 2015.

• Later in 2017, the state government launched its flagship initiative iStart Rajasthan to provide further impetus to entrepreneurial ecosystem in the state.

• The iStart ecosystem now has over 1500 registered startups.

• Rajasthan Government now aims to launch the Rajasthan Startup & Innovation Policy 2019 to build upon the momentum and to provide a newer, collaborative and expansive ecosystem.

Objectives of Rajasthan Startup & Innovation Policy 2019

• To promote an ecosystem through collaborative efforts to foster entrepreneurship in the state.

Period of the Policy

• The Policy shall remain in operation for a period of 5 years from the date of its notification or until substituted by another policy, whichever is earlier.

The Key Targets of Rajasthan Startup & Innovation Policy 2019

• Bring different stakeholders of the ecosystem on-board iStart. iStart to be the one- stop platform for startups and innovation in the state of Rajasthan

• The district level offices of DoIT&C will be strengthened to work for the purpose of development of the startup ecosystem

• Operationalize at least 5 sector specific Center of Excellences (CoE) specifically in the areas of agriculture, energy, artificial intelligence, niche technologies, Internet of Things (IoT), healthcare, tribal entrepreneurship, rural entrepreneurship, etc.

• Run at least 10 accelerator programs

• Issuance of at least 10 work orders every year under the Challenge for Change program

• Operationalize government owned and managed 10 incubators/ incubator like organizations in the state

• Facilitate the growth of 2,000 startups in the state

• Connecting 75 institutes with iStart

• Create 1 lakh employment through startups and

• Facilitate the mobilization of INR 100 crores of angel and venture capital for investment in the state by both managing its own fund as well as partnering with already existing funds.

Mission Agendas of Rajasthan Startup & Innovation Policy 2019

1. Institutional Setup

2. Simplified Regulations

3. Incubation

4. Financial Support to Startups

5. Fostering student Entrepreneurship

6. Outreach & Awareness

7. Policy Implementation & Execution

Other Salient features of the Policy:

The Rajasthan Startup & Innovation Policy 2019 also includes certain relevant features such as:

• A 15 member Startup Council under the chairmanship of the Chief Minister to play an advisory role and act as a think-tank for strengthening the startup ecosystem in the state.

• Constitution of the State Level Implementation Committee for recommendation of budgetary financial assistance and other ancillary activities for the program.

• Financial assistance in the form equity of up to INR 5 lakhs as Seed funding to assist startups in the prototype stage in product development, testing and trials, test marketing etc.

• A revolving fund of INR 500 crores – Rajasthan Innovation Vision Fund ( RAJIV Fund) will be established.

• In general, the state government will provide incentives and exemptions over and above those extended by the Government of India.

• The Policy defines startup as any entity defined as a startup by Government of India’s regulations and notifications.

A startup defined as an entity that is headquartered in India, which was opened less than 10 years ago, and has an annual turnover less than Rs. 100 crore (US$14 million).

—Definition of Startup, GOI

Rajasthan Special Investment Regions Act, 2016

• In order to achieve planned & systematic development of Special Investment Regions across the State and in DMIC region, a special legislation in the name of Rajasthan Special Investment Regions Act, 2016 have been notified on 26 April, 2016 and the rules under this Act have also been notified.

• To promote and monitor the development of SIRs, a State level “Rajasthan Special Investment Regions Board” has been constituted.

Ease of Doing Business

• The State Government has continuously pursued rationalizing the regulatory process for establishing businesses and industrial units across departments.

• To improve the Ease of Doing Business, State is following and implementing the yearly Business Reforms Action Plans (BRAP) of Department for Promotion of Industry and Internal Trade (DPIIT) Government of India.

Bureau of Investment Promotion (BIP):

• BIP is a nodal agency of the Government of Rajasthan that facilitates investments in various sectors in the state.

• It provides one stop service, mainly for large projects, by acting as an interface between entrepreneurs and the Government.

• BIP actively seeks to bring investment opportunities to the attention of potential investors, both domestic as well as foreign companies.

• For the purpose, 3 divisions of BIP namely:

• Investment Promotion Cell,

• Information Cell and

• Single Window Cell

are actively engaged in bringing the investments in the State.

Recent Initiatives:

Single Window Clearance System:

• New Single Window System has been developed by DoIT and launched on 1st June, 2016 on the basis of the guidelines for Ease Of Doing Business (EODB) by DIPP, Government of India.

• By November 2019, 100 services of 15 departments, which were required for setting up a business / enterprises were covered under SWCS.

Micro, Small and Medium Enterprises (MSME)

• MSMEs constitute an important segment in the economy as their contribution towards State’s industrial production, export, employment and creation of entrepreneurship base is quite significant.

• The achievements under various programmes/ schemes of industrial development are as follows:

Udhyog Aadhar Memorandum (UAM) of micro, small and medium Enterprises

• Udhyog Aadhar Memorandum Acknowledgement Act, 2015 has been implemented in Rajasthan State and online registration has been started, since 18 September, 2015.

• During the financial year 2018-19, 1,04584 industrial units have been registered online on UAM portal.

• These units have generated opportunity of direct employment for 4,65,445 persons.

Rajasthan Micro, Small and Medium Enterprises (Facilitation of Establishment and Operation) Act, 2019:

• In order to facilitate establishment of MSMEs in Rajasthan, the Government of Rajasthan had enacted the MSME Ordinance on 4 March, 2019, which got notified as MSME Act on 17h July, 2019.

• The Act provides for establishment of new micro, small and medium enterprises, on the Raj Udhyog Mitra portal.

• After receiving “Acknowledgment Certificate” online, the MSME units in the State are exempted from the approvals and inspections under all the laws of the Government of Rajasthan for a period of three years.

• Upto December 2019, total 2,878 numbers of Declaration of Intent have been received and for the same acknowledgement, certificates have been issued.

Mukhyamantri Laghu Udyog Protsahan Yojana (MLUPY):

• For setting up new enterprises in the manufacturing, service and trade sectors and for expansion, modernization, diversification of existing enterprises to provide loans upto 10 crore through financial institutions, “Mukhyamantri Laghu Udyog Protsahan Yojana” has been notified and has been commenced from 13h December, 2019.

• Under the scheme, small scale entrepreneurs will be provided 8 per cent interest subsidy on loans upto 25 lakh, 6 per cent on loans upto 5 crore, 5 per cent on loans upto 10 crore.

CSR in Rajasthan

• Corporate Social Responsibility refers to business practices involving initiatives that benefit society.

• It is not a new concept in India however the companies act 2013 provided for statutory guidelines to CSR in Rajasthan along-with with rest of India.

Updates of CSR Activities in Rajasthan

• Upto March, 2019, a total of 117 Corporates, 19 Government Departments, 207 implementing agencies & 33 service providers have registered themselves on the CSR . The amount of 572.9 crore is estimated to be incurred in 146 CSR projects across areas.

• As per information received from 134 Companies, which are operating in the State, the CSR expenditure incurred by them is 351.42 Crores in 2017-18.

CSR Rule:

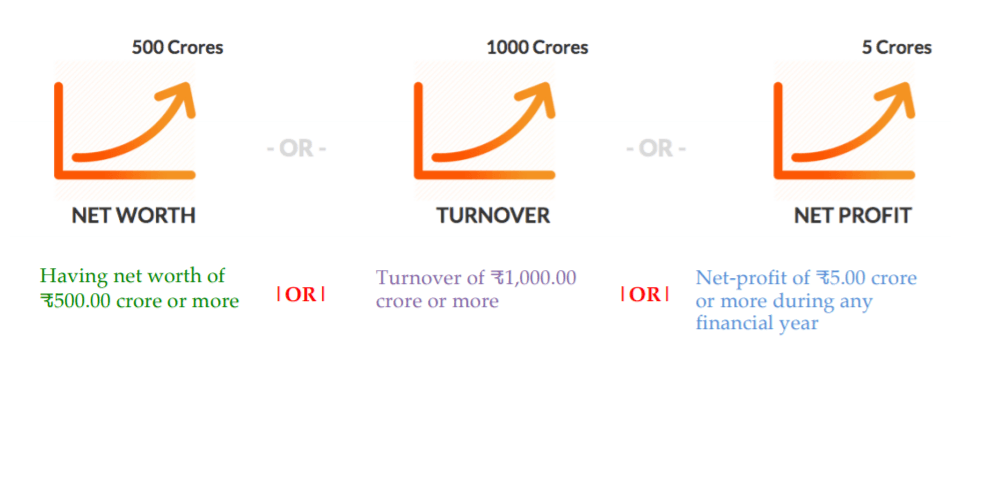

• As per section 135 of The Companies Act 2013, the companies which fulfils the following criterion during any financial year:

are required to spend 2 percent of the average net profits of the Company made during the three immediate preceding financial years in activities stated in Schedule-VII.

• According to Section-135 of Companies Act, 2013, CSR companies are directed to submit their CSR reports to Registrar of Companies, Ministry of Corporate Affairs, Government of India.

• State Government has no role to play in monitoring implementation of CSR by Companies.

Rajasthan Government Initiatives

• The state government of Rajasthan has taken various initiatives to promote & facilitate CSR activities by corporates in the state.

Rajasthan CSR Web Portal

• Rajasthan CSR Web Portal (www.csrrajasthangov.in) is a unique interactive portal created by Department of Industries, Government of Rajasthan.

• This portal is designed to identify and listing of CSR companies, CSR projects/programmes within the State. Companies can directly find out the implementing agencies and can recommend a CSR project to them.

Rajasthan CSR Authority

• In November 2019, the State Government has notified Rajasthan CSR Authority to guide, monitor, and partner companies for achieving scale and improving efficiency in implementing social welfare projects.

• The three-tier authority will be represented by the chief minister, chief secretary, additional chief secretary of industries, and commissioner of industries besides senior officials from various departments.