Hindu Undivided Family (HUF): Meaning, Formation and Status

Hindu Undivided Family (HUF) is a unique institution under Hindu law that combines family relations with joint ownership of property. It plays an important role in matters of inheritance, taxation, and management of family assets.

📚 Introduction

The concept of HUF is closely connected with Hindu Joint Family and coparcenary. It is frequently referred to in legal, financial, and taxation matters.

Questions on HUF are commonly asked in judicial service examinations, especially in relation to property rights and the powers of the Karta.

⚖️ Meaning of Hindu Undivided Family (HUF)

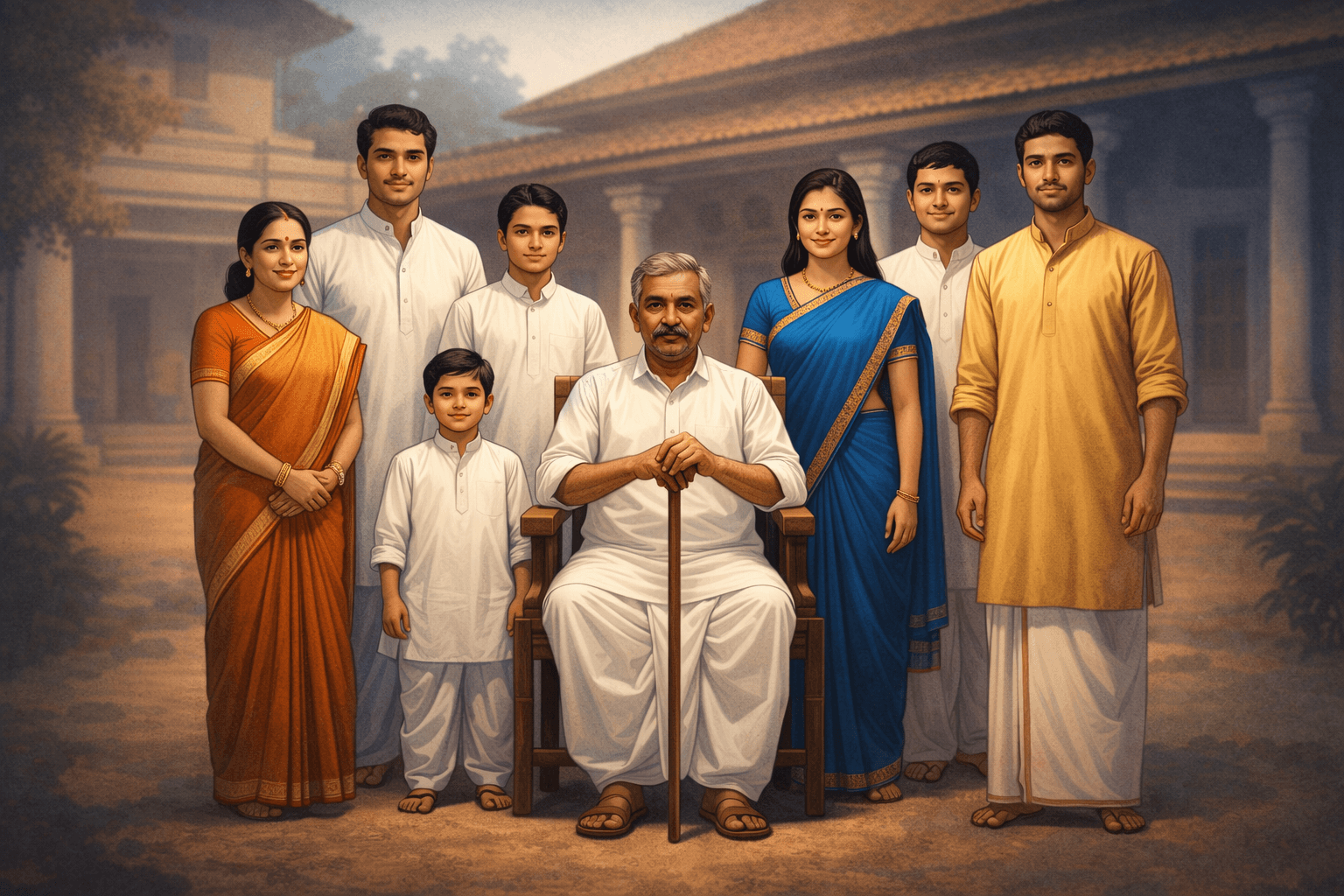

A Hindu Undivided Family is a family consisting of lineally descended members from a common ancestor along with their wives and unmarried daughters.

It is a legal entity recognized under Hindu law and tax laws for managing joint family property.

👨👩👧 Formation of HUF

An HUF is created automatically by operation of law. No formal registration or agreement is required for its formation.

An HUF comes into existence when a person gets married and starts a family, or when ancestral property is inherited.

Modes of Formation

- By birth in a Hindu family

- By marriage

- By inheritance of ancestral property

- By reunion of separated members

📜 Legal Status of HUF

An HUF is not a separate legal person like a company, but it is recognized as a distinct unit under law.

It can own property, enter into contracts, and file tax returns through its Karta.

🏠 Property of HUF

HUF property includes ancestral property, joint family property, and property acquired from joint family funds.

Such property is owned collectively by all members of the HUF.

👤 Management of HUF: Role of Karta

The Karta is the head of the HUF and manages its affairs. Generally, the senior-most male or female member acts as Karta.

The Karta represents the HUF in legal, financial, and administrative matters.

💼 HUF and Income Tax

Under income tax law, an HUF is treated as a separate taxable entity.

It can obtain a PAN card, open bank accounts, and claim tax deductions independently.

This makes HUF an important tool for family financial planning.

📝 Rights and Liabilities of Members

All members of an HUF have the right to maintenance and residence from joint family property.

Coparceners have additional rights such as demanding partition and claiming shares.

Members are also bound by liabilities incurred for family purposes.

⚖️ Partition of HUF

Partition means the division of joint family property among members.

It may be total or partial and results in separation of status and property.

📝 Importance for Judiciary Exams

HUF-related questions are often asked in exams concerning taxation, property disputes, and family law.

Candidates must understand its formation, legal status, and management.

📌 Conclusion

Hindu Undivided Family is a unique feature of Hindu law that promotes collective ownership and family unity.

It balances individual rights with joint responsibility and remains relevant in modern legal and financial systems.

📘 Stay Ahead with Delhi Law Academy!

Get access to free monthly current affairs, read our insightful blogs,

and explore free study resources prepared by experts at DLA Jaipur. 🚀

❓ Frequently Asked Questions (FAQs)

1️⃣ What is an HUF? ⚖️

An HUF is a family unit consisting of lineal descendants and recognized under Hindu law and tax law.

2️⃣ Is registration required to form an HUF? 📜

No, an HUF is created automatically by law and does not require registration.

3️⃣ Who is the Karta of an HUF? 👤

The senior-most member of the family, male or female, usually becomes the Karta.

4️⃣ Can an HUF have a separate PAN? 💼

Yes, an HUF can obtain its own PAN card and file separate tax returns.

5️⃣ Can women be members of an HUF? 👩⚖️

Yes, women are members and daughters are also coparceners after the 2005 amendment.

6️⃣ How is HUF property divided? 🏠

HUF property is divided through partition among coparceners.